Whether you’re a young professional or a middle-aged parent, the question of financial planning and investing will come up at some point in your life.

Finding the right answers, however, can be complicated. Which debts should you pay down first: the bigger ones or the smaller ones? How do you calculate your net worth, and what should you know before investing your money? This article will help you answer all those questions.

Let’s get started.

How much money do you want to make?

There are many elements to a sound financial plan, but an important starting point is setting some goals. Financial goals outline what you want to achieve and how much you will need to get there. This entails figuring out how much you spend on living expenses and how to save for the future.

“One of the most important aspects of financial planning is making sure you pay close attention to your short, medium, and long-term goals.”

Malik Shehu

But your goals should be realistic. If they’re too low, you might get frustrated or discouraged when you fail to reach them. And if they’re too high, you might despair that you’ll never reach them. Finding the right balance is key.

Whenever I’m advising a client, I tell them about the 3 time horizons in life:

- The short term: “I need to pay my child’s school fees at the end of the year.”

- The medium-term: “I need to put a down-payment on a property in 3-5 years.”

- The long term: “Where do I want to live when I retire?”

These horizons allow you to prioritize your goals and plan your finances accordingly. But first, you have to figure out how much you earn, how much you currently have, and how much you can afford to save or invest.

Getting started: How to calculate your net worth

There are 4 main elements to the net worth equation, which are:

- Your income and expenses

- Your short term balances

- Your debt, and

- Your medium to long term investments

Here’s how to calculate each one using our special Financial Planning Workbook template (click to view and make a copy for yourself).

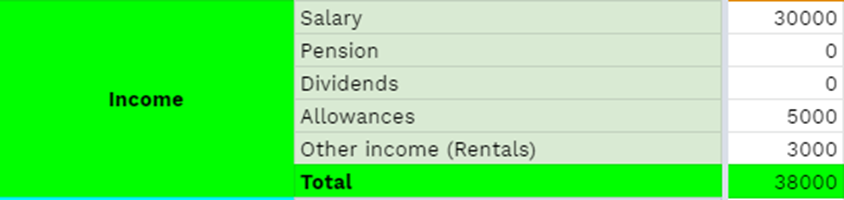

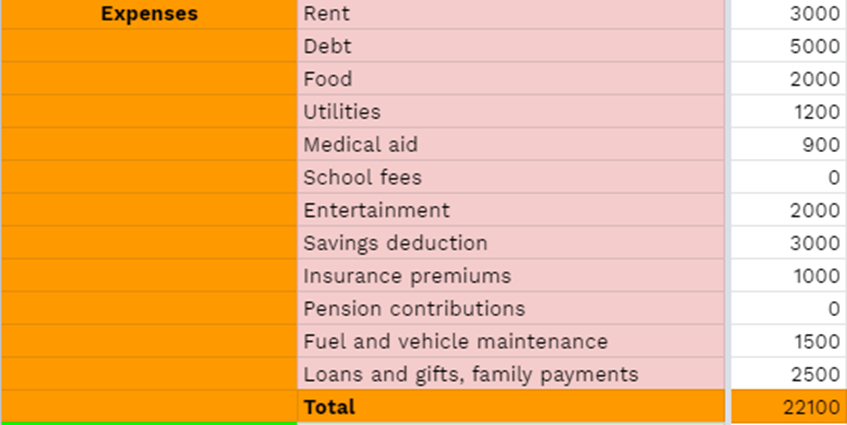

#1 Your income and expenses

You might be earning an income from your day job, freelancing on the side, or getting an allowance. In the Money Template’s income column, enter the amount of money you earn after tax each month.

Then, estimate all your expenses from fuel to food and school fees. Include any insurance premiums, medical aid premiums, and savings debit orders.

The spreadsheet will automatically calculate and display your Monthly Expenses and “Discretionary Income.”

Your discretionary income shows you how much money you have left at the end of each month to use to make more money. If you have a high discretionary income, you can invest that amount each month to compound it down the line. If your discretionary income is low, consider saving up for a while to invest a lump sum.

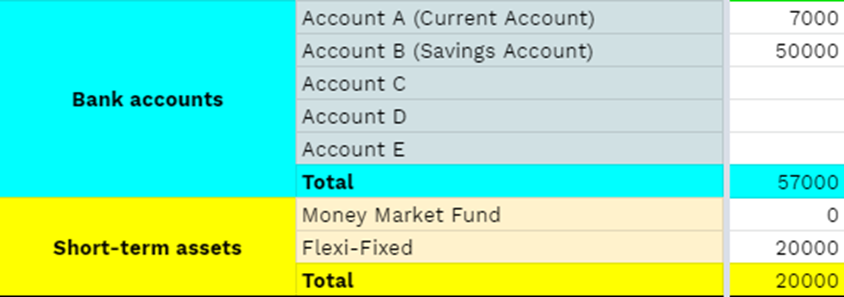

#2 Your short-term asset balances

To calculate your short term asset balances, write down the amount of money you have in each of your bank accounts in the [x] column. Feel free to add extra columns if you have more than 3 accounts.

Keeping track of your short term asset balances lets you know how quickly you can access cash for emergencies. If something happened tomorrow, would you be able to withdraw your money immediately, or would you need to wait for 32 days?

Before you invest your money, work on building up a cash reserve for emergencies — your “rainy day fund.” Your rainy day fund should cover at least 3-6 months of expenses based on your current lifestyle.

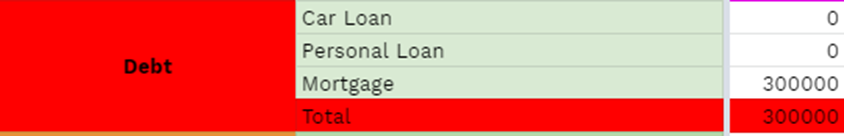

#3 Your debt

Debt can be debilitating. You need to manage it well to avoid harming your financial future. To get started, ask yourselves a few questions:

- How much debt do I have?

- What are the monthly installments?

- How many more installments do I have left?

- Can I afford to pay extra each month to repay the debt faster?

In the spreadsheet, you’ll find the Debt column with a few sub-columns under it. Enter the necessary information, and the Total Debt column will be automatically updated.

So how can you clear your debt? There are two main ways to repay your debt faster:

- Pay the smallest amounts off first, and use the money you free up to pay off the larger ones. This is called the “Snowball Method,” which gives you a positive psychological boost with each debt you clear.

- Pay the debt with the highest interest off first, and roll the freed-up cash into paying off the lower interest debt faster. This is the “Avalanche Method” and makes you feel badass.

Deciding between the Snowball Method vs. the Avalanche Method will depend on things like the interest rates on your debt, your repayment terms, and your discretionary income. We’ll cover all of these in a future article.

Another question I get a lot: “Should I pay off my debt first, then invest my discretionary income, or can I do both concurrently?”

The answer depends on the amount of discretionary income you have, the interest rates you’ll get from your investments vs. the interest rates on your debts, and other key factors.

Just keep in mind that every debt you clear becomes discretionary income you can put into your rainy-day fund or invest into income-generating assets.

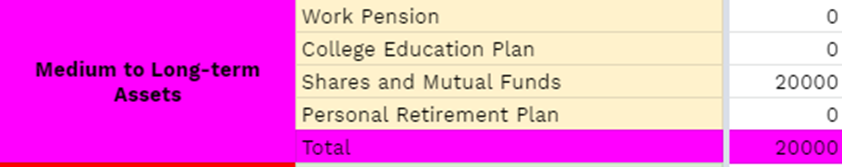

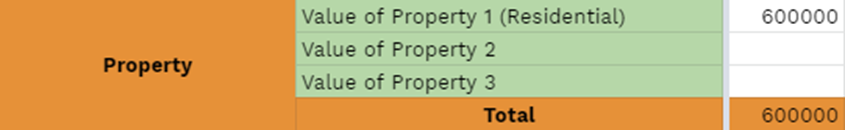

#4 Your medium to long term investments

Your medium to long-term investments include things like your pension and properties. The [x] column in the spreadsheet provides space to enter each of these assets’ current values.

If your company manages your pension, speak to HR to know how much you’ve accrued so far. And if you’re not sure how much your property portfolio is worth, get an asset valuation company to help you out.

Total net worth calculation

Once you’ve entered all your figures, the spreadsheet will automatically calculate your net worth by subtracting your liabilities from your assets.

Congrats! You now know how much you’re worth right now.

It’s important to stress that last bit because your net worth will rise and fall and different stages of your life — and that’s ok. As long as you work on increasing your assets and decreasing your liabilities, you’ll be fine.

Planning for your future: How to start investing

By now, you’ve calculated your asset values, figured out your debts, and gotten an idea of how much discretionary income you have to invest. So, how can you use your assets today to create wealth tomorrow?

There are three steps to this:

- Figure out your investment goals

- Decide on a plan of action

- Get professional help

Let’s take a quick look at each.

#1 How to figure out your investment goals

Before you start investing your hard-earned money, you first need to figure out your “investment horizon” — your timeframe for reaching your goals. This outlines where you want to be and what you want to do or have in the next 2, 5, 10, 20, and 50 years. When you know your investment horizon, you can plan adequately for future events.

For example, if you just had a baby, you might be thinking about how you’ll pay for their college tuition. You might want to start saving for the next 18 years to be able to afford it. Or maybe you want to retire in the next 20-40 years — in which case you’ll need to assess how much you’ll need to live comfortably in your old age.

Each of these goals requires you to have a plan, which we’ll look at next.

#2 How to decide on your investment plan

Once you’ve set some goals, it’s time to make a plan to help you reach them. This action plan will depend on 7 key factors:

- Discretionary income: Do you have enough discretionary income (excluding your rainy day fund) to invest? If not, work on increasing your discretionary income first.

- Savings: The money in your account(s) is capital that you can invest. You can invest a small amount each month or save up and invest a lump sum.

- Asset classes: Which asset classes are you looking to invest in? Equities? Bonds? Mutual funds? Property? Farming? Each category has its pros and cons and comes with its own level of risk.

- Risk appetite: How much risk can you handle? Some investments like real estate provide modest returns for modest risk. Others, like stocks and equities, offer higher returns for higher risk. And assets like bonds offer low returns but are considered the safest bet. To maximize your investment portfolio, have a mix of different assets.

- Proximity: Are you looking to invest offshore or onshore? Depending on your country’s capital markets and economy, going offshore gives you a vast and diverse range of investment opportunities.

- Flexibility and accessibility: How quickly do you want to be able to access your cash? This is called “liquidity,” and some investments are more liquid than others. If you know you’ll need the money sometime soon, consider picking a more flexible investment option that’ll let you pull out your money on short notice or reduce your monthly commitment when you need to.

- Discipline: This is the most critical element: how disciplined are you? If you aren’t able to commit to your plan, you’ll take much longer to reach your goals.

Consider these 7 factors thoroughly as you plan your investment journey. However, you don’t have to do it alone; you can get professional help.

#3 Getting help: How to choose the right financial advisor

With your goals and plans in mind, you might need help making sense of all the investment options out there. A financial advisor can help you navigate this complicated process and maximize your investments. But there are some things to keep in mind.

Firstly, you want a certified financial advisor from a reputable company with the right licenses, training, and experience to advise you on your money. Unlicensed financial advisors might advise you to invest in dubious assets they have little knowledge of.

After setting a meeting with a financial adviser of your choice, ask them the following questions:

- How long have you been advising clients? An advisor fresh out of training might not be the right person to help you manage your millions since they haven’t built up the experience yet.

- How many clients are you currently advising? While a high number of clients might be a good sign, you also don’t want an advisor with too many clients, as that means they won’t be able to focus on your needs adequately.

- What’s the value of your assets under management? The more assets and asset classes they are managing, the more knowledgeable they might be about helping you manage and grow your wealth.

- What’s your academic and professional background? You might be wondering why you should care about their background. That’s because many “financial advisors” are really just salespeople who don’t understand the intricacies of the financial markets. This means they wouldn’t know how to advise you if the markets became chaotic. Asking them about their academic and professional background helps you determine if your money is in good hands.

- How often do you service your clients? You don’t want a fly-by-night type of advisor who disappears after selling you an investment product. Find out how often they check in with their clients and what kind of access you’ll have to them — whether that’s by phone, email, Zoom, in-person meetings, etc.

- What’s your commission structure? Some advisors get a lump sum or percentage payment for each product they sell you. This means that they’re incentivized to sell you more products (and more expensive ones) so they can make more money. This is not in your best interest. Others get a salary each month regardless of how many products they sell you, which means they can afford to give you unbiased advice. Make sure you understand your advisor’s commission structure right off the bat.

- What are the charges? A common question clients don’t ask about is the fee for each transaction: depositing cash, withdrawing cash, and the monthly or annual advisory fee. Your advisor’s goal is to grow your money, so find out how much they’re billing you and how much you actually keep.

- How often do you send portfolio reports? It’s essential to get regular updates on how your investments are doing, and it’s your advisor’s job to send you monthly, quarterly, or annual reports. This way, you can track your deposits, market losses, and accrued interest. Be wary of advisors who don’t give you this information or who don’t send it to you regularly.

Financial advisors and investment brokers can be your guiding light in terms of asset and wealth management. However, there are plenty of shady characters out there who might not have your best interests at heart. Do your due diligence when choosing a financial advisor so you don’t get scammed.

Meet with a financial advisor to discuss your goals.

Get started

Sound financial planning is your key to reducing debt, increasing your discretionary income, and investing for the long term. You need to consider many factors on your journey to financial freedom, such as your goals, risk profile, and preferred action plan.

A certified financial advisor with the right experience can help you navigate this journey, but it can be hard to find the right one in a sea of options. If you’re looking for unbiased financial advice from a reputable advisor with more than BWP 15 million under management, get in touch.