What does money mean to you?

To me, it means access. Access to that nice restaurant, Burna Boy concert, or great school for my kids.

I asked people what money means to them — here’s what they said:

You know what money means to you, but do you know what’s stopping you from reaching those goals?

Through experience, I’ve boiled it down to five damaging habits — habits you can easily overcome today.

They are:

- Impatience

- Not upskilling

- Not saying no

- Not investing

- Not diversifying

#1 Impatience

You prefer instant gratification over delayed gratification.

You aren’t willing to let your money work on your behalf over time.

You want to get it now instead of later.

Impatience causes you to spend money as soon as you get it, or pull out of your investments after a short time.

Big mistake.

You wouldn’t hit the gym for two weeks and expect to have washboard abs. You’d need to exercise consistently for that to happen.

Similarly, you need to let your money work on your behalf through investments, and not expect quick miracles.

Patience offers peace of mind, too. When you are patient, short-term volatility doesn’t worry you.

You get to see the fruits of your labor grow, giving you a higher total return.

So, stop being impatient.

Plant your financial seed, water and nurture it, and watch your financial fruits grow.

#2 Not upskilling

Having only one skill (which you don’t improve) won’t get you to financial success.

The key is to keep upskilling yourself.

You studied computer science? Learn more about programming, coding, AI, and machine learning.

You did art? Learn more about digital art, NFTs, and marketing.

Upskilling improves your knowledge and swells your bank account.

Stop being comfortable with what you already know. Learn more to earn more.

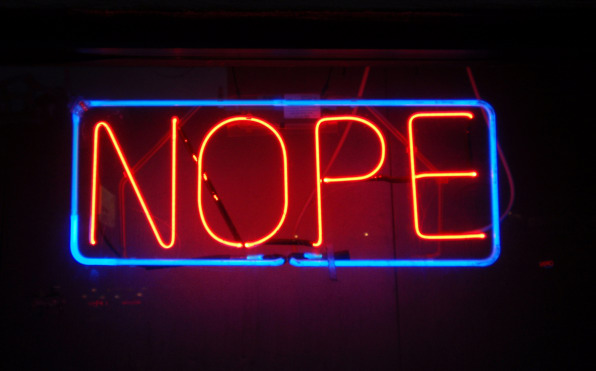

#3 Not saying “No”

Weak financial discipline kills money dreams.

It occurs when your friends want to go out and you join them despite your negative bank balance.

It happens when you splurge on a nice bag, pair of shoes, or phone even though you didn’t budget for it.

Here are 2 rules:

- If you can’t afford it twice, don’t buy it.

- Live within your means.

You don’t always have to spend. Let your money rest and grow.

#4 Not investing — only saving

Banks are not meant to make you money. They are meant to safeguard your money.

Banks loan your money out to make more money from debtors. In exchange for this, most banks offer disappointingly low savings rates.

Here are some of the savings rates of banks across the world for a 1 year fixed deposit:

- Common Wealth Bank of Australia: 1.25%

- First National Bank of Botswana: up to 1.92%

- Wells Fargo: 0.01%

- HSBC: 0.55%

To put things into perspective, here are the current inflation rates in America, Australia, the United Kingdom, and Botswana, respectively:

This means what the bank gives you for saving your money doesn’t even beat inflation.

Inflation is the rate of increase in prices of goods over time. You ideally want your savings to beat inflation.

Investing helps you beat inflation. You can grow your wealth by investing in more risky assets like:

- Stocks

- Mutual funds

- Property

- Derivatives

- Forex

#5 Not diversifying

Diversification reduces risk and betters your returns.

By investing in only one thing, you risk losing a lot.

If you invested all your life savings in the stock market in 2008, you’d have cried at the end of the year. This is because the sub-prime mortgage crisis spread across financial markets worldwide and negatively affected them. The image below shows the performances of 3 indices – representing the US, UK, and China – during 2008:

Don’t put all your eggs in one basket. Diversify your investments.

Try investing in different asset classes across different industries and regions.

Examples:

Invest in different sectors like energy, tech, healthcare, and financial services.

Invest in mutual funds with exposure to Asia, Europe, Australia, and Africa.

Lastly, invest in different asset classes such as equities, bonds, and alternative investments (like property).

Overcome bad financial habits today

All it takes is a determined, disciplined, and decisive mindset to start your journey to financial prosperity.

Seeking help from a financial advisor gets you there faster.

Like the Chinese proverb says, “The best time to plant a tree was 20 years ago. The second best time is now”.

Start overcoming bad financial habits today.